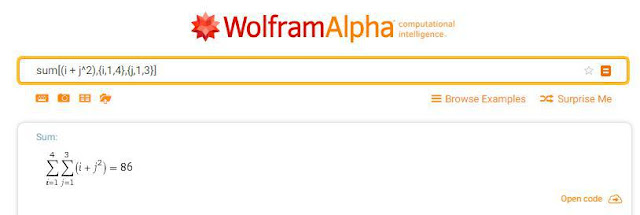

#Wolframalpha sum series#

Calculating the Future Value of an Ordinary Annuityįuture value (FV) is a measure of how much a series of regular payments will be worth at some point in the future, given a specified You can calculate the present or future value for an ordinary annuity or an annuity due using the following formulas. Rent, which landlords typically require at the beginning of each month, is a common example. Annuities due: With an annuity due, by contrast, payments come at the beginning of each period.For example, bonds generally pay interest at the end of every six months. Ordinary annuities: An ordinary annuity makes (or requires) payments at the end of each.The present value is how much money would be required now to produce those future payments.Īnnuities, in this sense of the word, break down into two basic types: ordinary annuities and annuities due.The future value of an annuity is the total value of payments at a specific point in time.With annuities due, they're made at the beginning of the period. In ordinary annuities, payments are made at the end of each period.Recurring payments, such as the rent on anĪpartment or interest on a bond, are sometimes referred to as "annuities.".Here's what you need to know about calculating the present value (PV) or There are several ways to measure the cost of making such payments or what they're ultimately worth. These recurring or ongoing payments are technically referred to as "annuities" (not to be confused with the financial product called an annuity, though the two are related). Payments for a period of time, such as interest from a bond or certificate of deposit (CD). Most of us have had the experience of making a series of fixed payments over a period of time-such as rent or car payments-or receiving a series of Plots are automatically generated to show at a glance how the future value of money could be affected by changes in interest rate, interest period or desired The effects of compound interest-with compounding periods ranging from daily to annually-may also be included in the formula. Partial Fraction Decomposition Calculatorįuture value basics The future value formula is used to determine the value of a given asset or amount of cash in the future, allowing forįor example, this formula may be used to calculate how much money will be in a savings account at a given point in time given a specified interest rate.future value with PV = $500 in 10 years.calculate interest PV $700 FV 1000 12 periods compounded monthly.Your input can include complete details about loan amounts, down payments and other variables, or you can add, remove and modify values and parameters using a simple form interface. The effects that different interest rates, interest periods or starting amounts could have on your future returns.Įnter your queries using plain English. Plots are automatically generated to help you visualize

Wolfram|Alpha can quickly and easily compute the future value of money in savings accounts or other investment instruments that accumulate interest over time.

Calculating the Present Value of an Ordinary Annuity.Calculating the Future Value of an Ordinary Annuity.The future value formula is used to determine the value of a given asset or amount of cash in the future, allowing for.Powerful computation of the future value of money.Compute future returns on investments with Wolfram|Alpha.

0 kommentar(er)

0 kommentar(er)